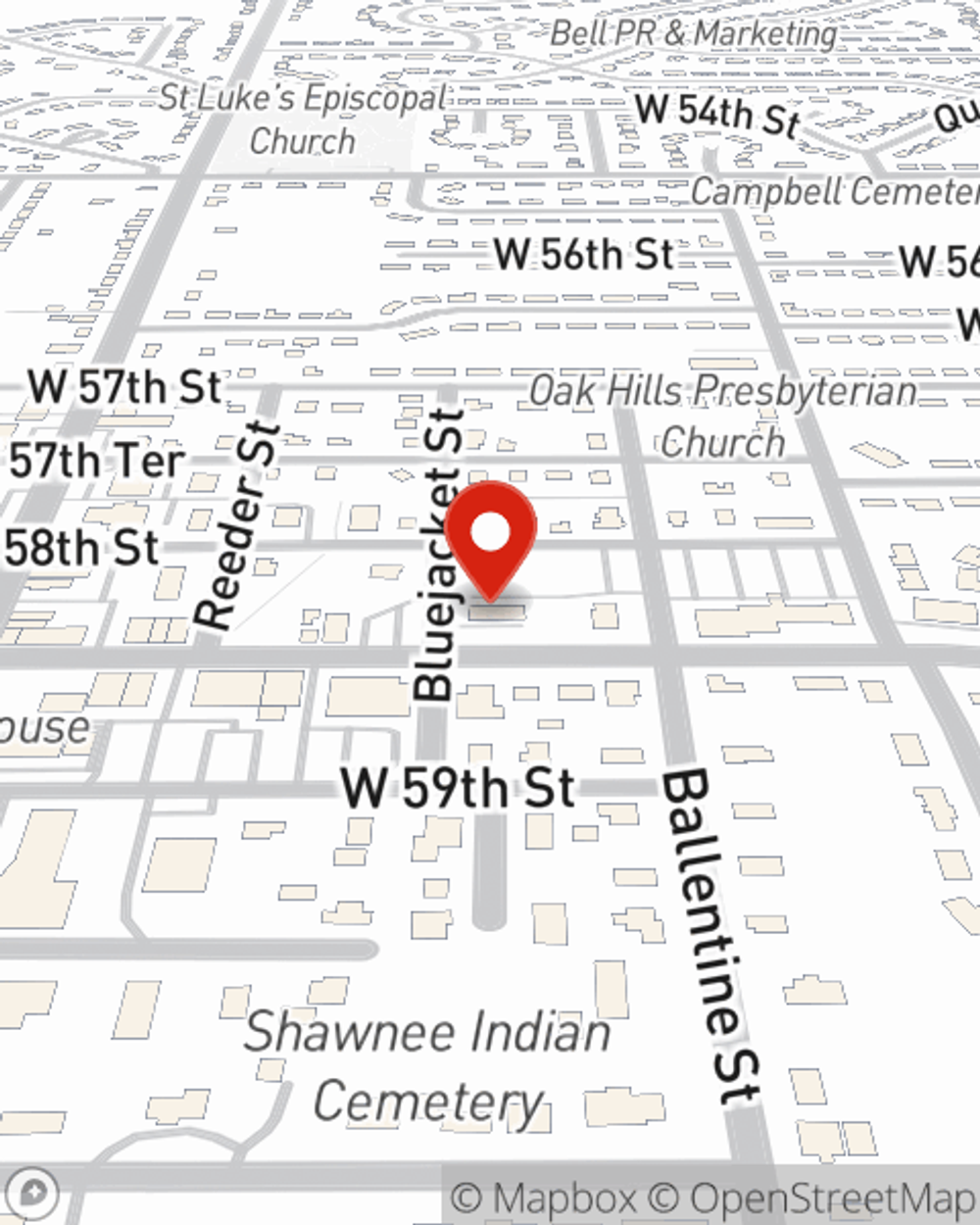

Renters Insurance in and around Shawnee

Your renters insurance search is over, Shawnee

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Shawnee

- Kansas city

- Merriam

- Mission

- Olathe

- Overland Park

- De Soto

- Eudora

- Bonner Springs

- Johnson county

- Wyandotte county

- Kansas

- Lenexa

- Prairie Village

- Grandview

- Lansing

- Leavenworth

- Spring Hill

- Missouri

- Gardner

- Paola

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or apartment, renters insurance can be one of those most reasonable things you can do to protect your belongings, including your sports equipment, silverware, video games, stereo, and more.

Your renters insurance search is over, Shawnee

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Mitzi Ryburn can help you build a policy for when the unpredictable, like a water leak or an accident, affects your personal belongings.

There's no better time than the present! Contact Mitzi Ryburn's office today to help make life go right in your rented home.

Have More Questions About Renters Insurance?

Call Mitzi at (913) 631-0201 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Mitzi Ryburn

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.