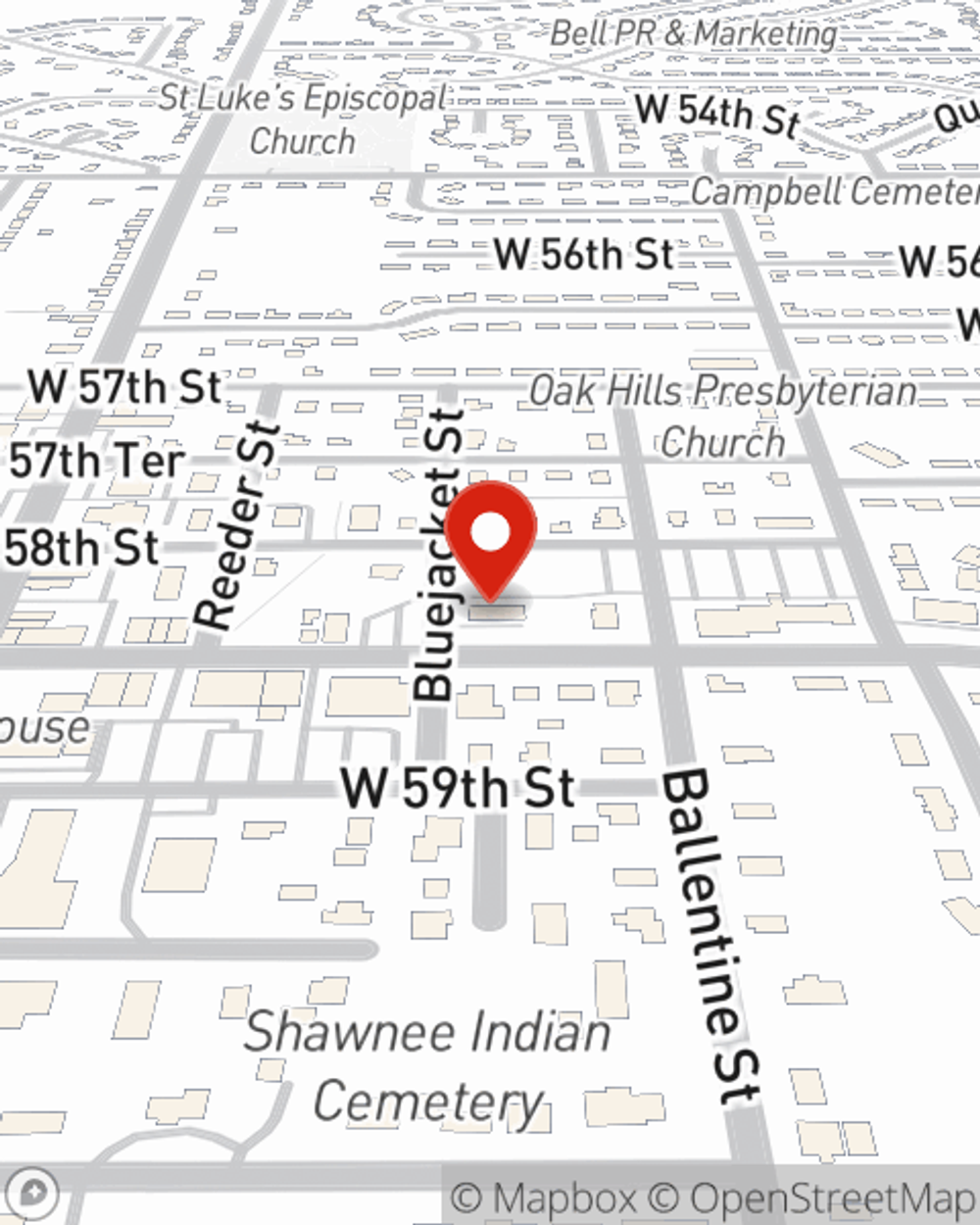

Life Insurance in and around Shawnee

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Shawnee

- Kansas city

- Merriam

- Mission

- Olathe

- Overland Park

- De Soto

- Eudora

- Bonner Springs

- Johnson county

- Wyandotte county

- Kansas

- Lenexa

- Prairie Village

- Grandview

- Lansing

- Leavenworth

- Spring Hill

- Missouri

- Gardner

- Paola

Protect Those You Love Most

The standard cost of funerals today is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your loved ones to manage that expense as they face grief and pain. That's where Life insurance with State Farm comes in. Having the right coverage can help the people you love pay for burial costs and not experience financial hardship.

Coverage for your loved ones' sake

Life happens. Don't wait.

Shawnee Chooses Life Insurance From State Farm

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep those you love safe with a policy that’s modified to match your specific needs. Thank goodness that you won’t have to figure that out on your own. With solid values and outstanding customer service, State Farm Agent Mitzi Ryburn walks you through every step to build a policy that safeguards your loved ones and everything you’ve planned for them.

Simply reach out to State Farm agent Mitzi Ryburn's office today to find out how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Mitzi at (913) 631-0201 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Mitzi Ryburn

State Farm® Insurance AgentSimple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.