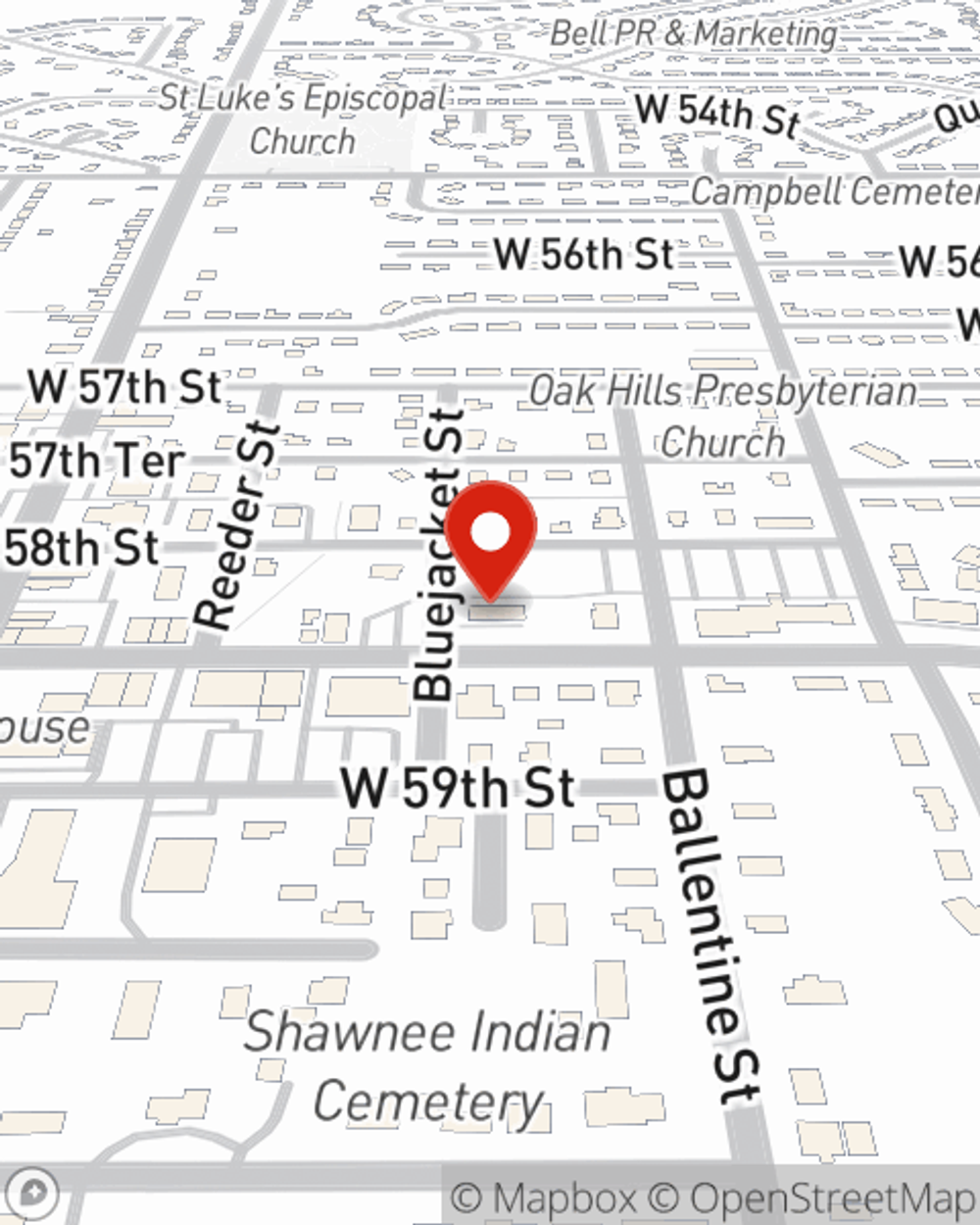

Business Insurance in and around Shawnee

One of Shawnee’s top choices for small business insurance.

This small business insurance is not risky

- Shawnee

- Kansas city

- Merriam

- Mission

- Olathe

- Overland Park

- De Soto

- Eudora

- Bonner Springs

- Johnson county

- Wyandotte county

- Kansas

- Lenexa

- Prairie Village

- Grandview

- Lansing

- Leavenworth

- Spring Hill

- Missouri

- Gardner

- Paola

Help Prepare Your Business For The Unexpected.

Whether you own a a pharmacy, a stained glass shop, or a fabric store, State Farm has small business insurance that can help. That way, amid all the different options and moving pieces, you can focus on what matters most.

One of Shawnee’s top choices for small business insurance.

This small business insurance is not risky

Customizable Coverage For Your Business

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Mitzi Ryburn. With an agent like Mitzi Ryburn, your coverage can include great options, such as artisan and service contractors, commercial auto and business owners policies.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Mitzi Ryburn's office today to discuss your options and get started!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Mitzi Ryburn

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.